Buying a House with Solar Panels in 2025: What You Need to Know Before You Sign

House hunting? You’re probably juggling a hundred decisions—neighborhoods, schools, square footage, countertops. But if you find a home with solar panels already installed, you might’ve just stumbled into a pretty great deal... or a massive headache. Let’s break it down so you don’t get burned.

So, the house has solar. Is that a good thing?

Yes, it can be. Solar panels slash electric bills, boost property value, and let you stick it to rising utility costs. But the devil’s in the details: who owns the panels, how they were paid for, and what condition they’re in all matter a lot.

1. Find out how the panels were paid for

Before you fall in love with that energy-efficient dream home, ask this:

- Were the panels paid for in full?

- Are they leased?

- Is there an outstanding loan?

- Were they financed through PACE?

Each option comes with its own checklist. Here’s what you’re getting into:

2. Fully Owned Solar Panels = Best Case Scenario

If the seller paid upfront for the solar system, you’re golden. No monthly payments, no contracts, just savings. You'll want:

✅ A copy of the purchase agreement

✅ Transfer paperwork from the installer

✅ Warranty info

✅ A Net Metering (NEM) agreement with the utility

Just know that federal tax credits already claimed by the original owner don’t transfer to you—but other local incentives might. Ask!

3. Leased Panels = Proceed with Caution

Leased solar isn’t necessarily bad, but it is more complicated.

You’re taking over someone else’s contract, so:

- Get a copy of the lease

- Ask about monthly payments

- Look for escalators (automatic yearly increases)

- Check for early termination fees

- See if there’s a buyout option

Oh—and make sure that lease won’t interfere with your mortgage approval. Lenders do care.

If the system is under a PPA (Power Purchase Agreement), you're paying per kWh used instead of a flat monthly rate. Do the math and make sure it still saves you money.

4. Solar Loan? You Might Not Have to Worry

In most cases, the seller will pay off the loan before closing, and the solar system gets wrapped into the home’s value. But if they want you to assume the loan, ask:

- Is it secured or unsecured?

- What’s the interest rate?

- What’s the remaining balance and loan term?

Also check if the system qualifies for net metering or performance-based incentives that offset your payment.

In some states (like Missouri), PACE financing gets paid through property taxes. That stays with the house. If you’re buying a PACE home, make sure the numbers still work for your budget.

5. Check the Roof (Seriously)

Solar panels are great, but if the roof underneath is falling apart? Not so much. Get the roof inspected.

🛠️ A general home inspection isn’t always enough

🛠️ Consider a dedicated roof inspection ($150–$500)

🛠️ If repairs are needed, panel removal can cost $1,500–$6,000

Use this info to negotiate. Don’t get stuck footing the bill for someone else’s deferred maintenance.

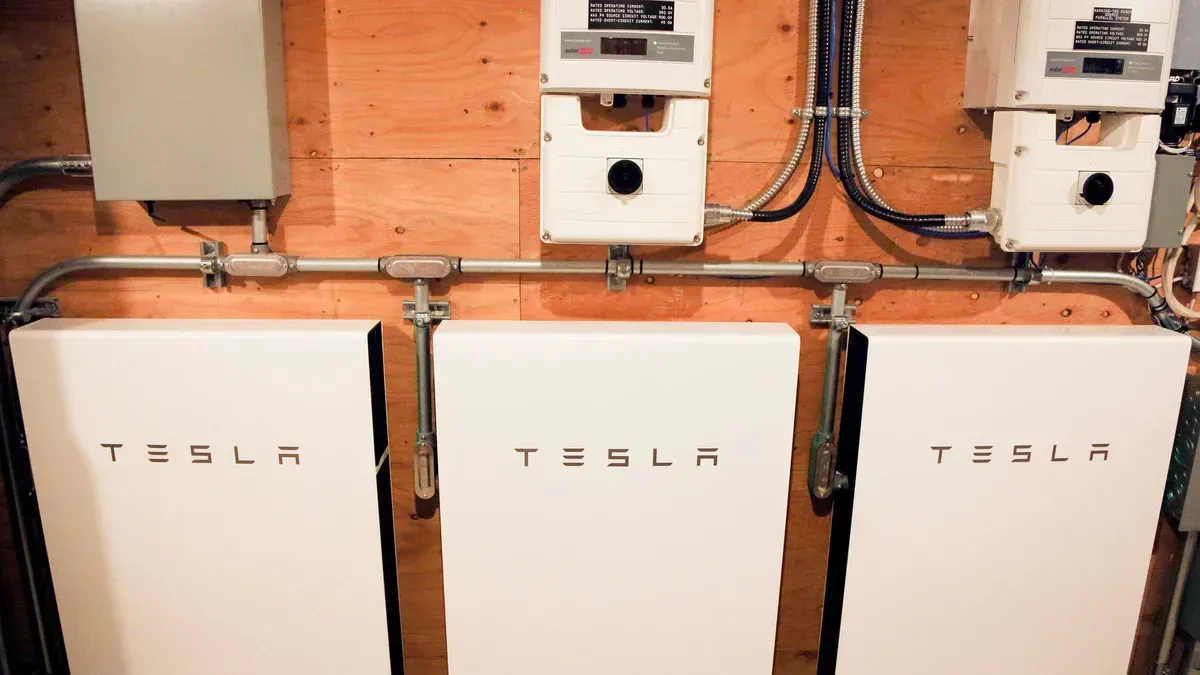

6. Check the Panels, Too

Solar panels usually last 25–30 years, but they do degrade slowly over time. Ask for:

- Performance reports or access to the system’s monitoring app

- Warranty information (most are transferable)

- A rundown of any past maintenance or repairs

Make sure they’re still doing what they were installed to do—saving money.

Bottom Line

A house with solar panels can be a huge win—if you do your homework. Always ask the seller and your agent for documentation and don’t be afraid to loop in your own inspector, electrician, or solar installer to give the system a second look.

Thinking about buying a solar home in Missouri?

The

SunSent Solar team is always happy to take a look at the system, explain the setup, and help you make a smart decision. We’ve got your back.

Want to turn your home into a solar-powered powerhouse? Contact SunSent Solar today.