How Much Money Can You Save with Solar Energy?

Lowering electricity bills is one of the biggest reasons homeowners switch to solar. But how much can you actually save? The answer depends on several factors, including your energy consumption, roof suitability, financing options, and available incentives. Let’s break it down, using insights from the U.S. Department of Energy (DOE) to help you understand your potential savings.

How Solar Savings Work

1. How Much Electricity Can You Produce?

Your home’s ability to generate solar power depends on your roof’s size, shape, slope, and shading. South-facing roofs with a tilt of 15 to 40 degrees generally perform best. If your roof isn’t ideal, community solar programs can be a great alternative.

2. How Much Electricity Do You Use?

Your utility bill shows your monthly electricity usage. The more energy you consume, the greater the potential savings. Some utilities also offer net metering, which credits you for excess solar power sent back to the grid, further reducing costs.

3. How You Pay for Solar Matters

Solar panels can be financed in several ways:

- Cash Purchase – Highest upfront cost but delivers the most savings over time.

- Solar Loans – Spread out payments while still owning your system.

- Power Purchase Agreements (PPA) – No ownership, but you pay a lower rate for electricity from solar panels installed on your home.

Each option affects how quickly you’ll break even on your investment.

4. Taking Advantage of Incentives

The Federal Solar Tax Credit allows homeowners to deduct 30% of their solar installation costs from their federal taxes. Many states and utilities also offer rebates and incentives. You can check DSIRE (Database of State Incentives for Renewables & Efficiency) for local programs.

Calculating Your Solar Payback Period

Your solar payback period is how long it takes for your system to pay for itself. Here’s a simple formula:

- Subtract upfront incentives from your system’s total cost.

- Calculate annual savings by multiplying your average monthly electricity bill by 12.

- Divide the cost by annual savings to determine how many years it takes to break even.

For example:

- A homeowner with a $15,000 solar system and a 30% tax credit ($4,500) has a net cost of $10,500.

- If they save $1,500 per year on electricity, their payback period is 7 years.

- After this period, electricity savings go directly into their pocket!

The faster electricity prices rise, the greater your long-term savings. In many cases, solar provides a better return than traditional investments.

Real-Life Solar Savings Scenarios

- A homeowner buys a system with cash, gets a 30% tax credit, and saves $200/month, paying off their system in less than 5 years.

- A family leases solar panels, saving $50/month on electricity with no upfront costs.

- A couple finances solar with a loan, paying $150/month while saving $220/month on electricity.

- An apartment renter subscribes to a community solar project, reducing their bill by $42/month.

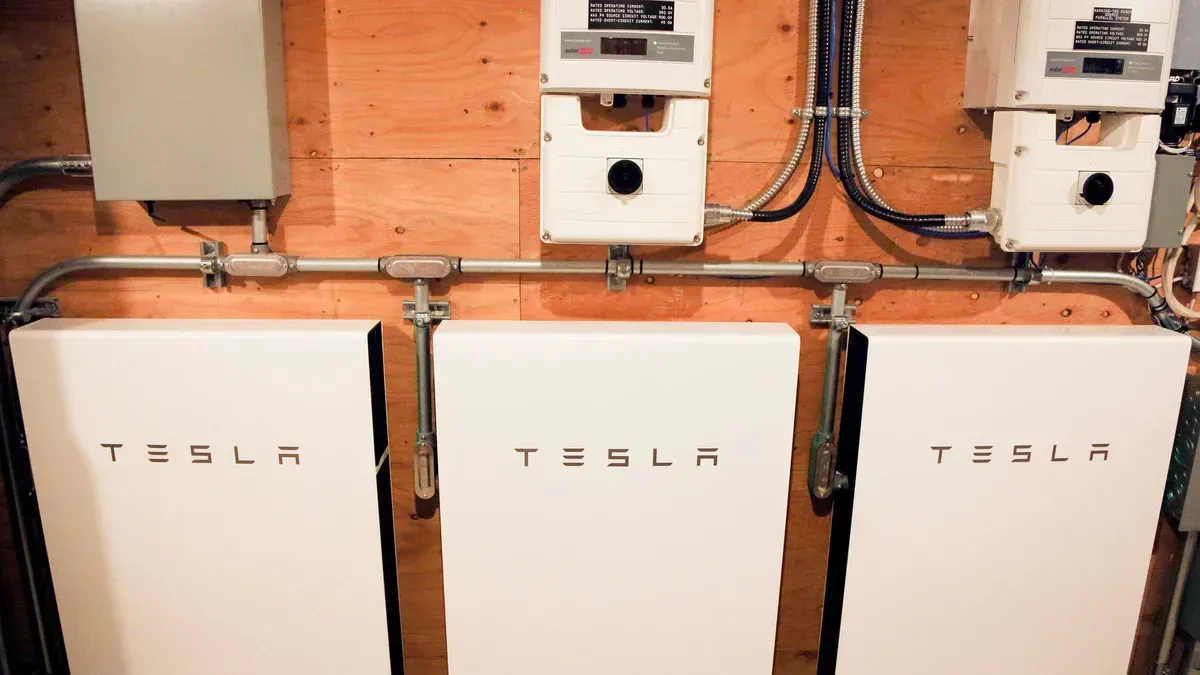

- A teacher installs solar plus battery storage, saving $275/month while ensuring backup power during outages.

When Solar Isn’t an Option

If you rent or have a roof that isn’t solar-friendly, community solar allows you to benefit from solar savings without installing panels. These programs let you subscribe to a shared solar farm, and you’ll receive credits on your electricity bill.

Final Thoughts

While exact savings vary, solar energy offers a reliable way to cut electricity costs and protect against rising utility rates. With tax incentives, net metering, and financing options, switching to solar has never been more accessible.

Want to find out how much you could save? Call SunSent Solar today for a free consultation or fill out the form at sunsent.com.

Want to know how much you could save in St. Louis, Missouri? Read our blog post!