The Comprehensive Guide to Solar Panel Financing & Installation in Illinois (2024)

As energy costs continue to rise and environmental concerns become more pressing, solar energy is becoming an increasingly attractive option for Illinois homeowners. With a combination of state incentives, federal tax credits, and the decreasing costs of solar technology, solar panel financing has never been easier.

That’s why the team from SunSent Solar has collected this insightful guide for you here.

4 Reasons to Install Home Solar Panels

Solar panels offer a wide array of benefits beyond just financial savings. Here’s why you should consider making the switch to solar energy:

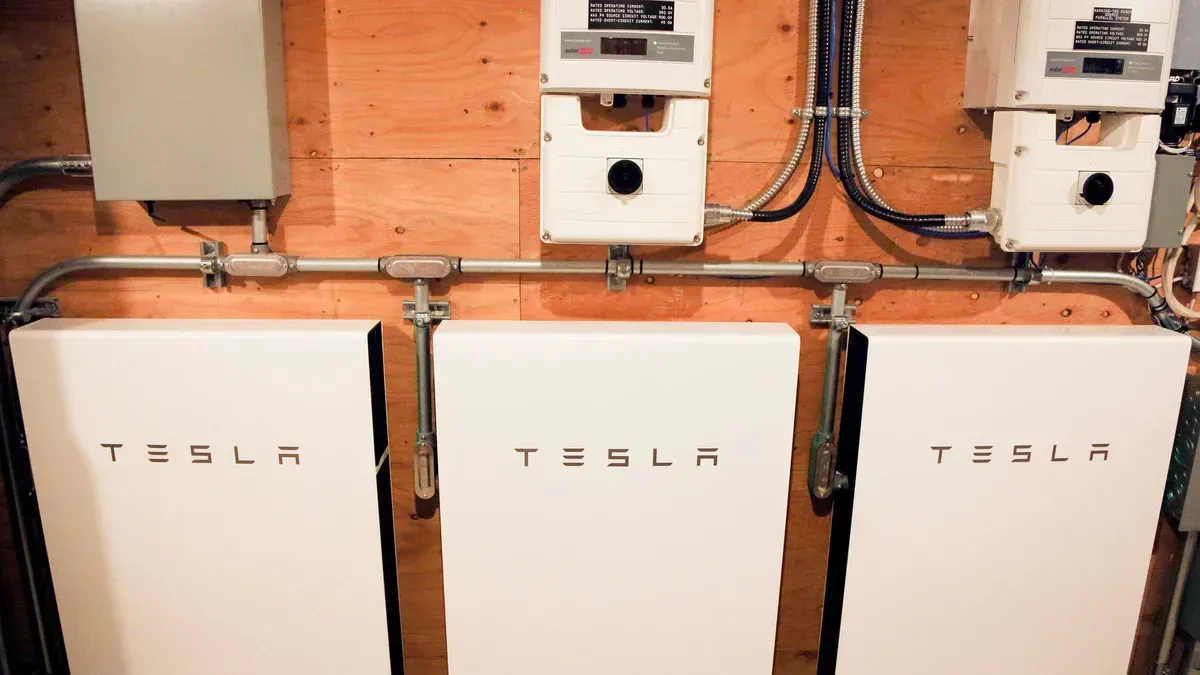

1. Energy Security: As the electric grid faces more frequent disruptions, energy security is becoming a critical concern. Solar energy offers a safeguard against rising electricity rates, unstable power supply, and the risk of blackouts. The peace of mind that comes with knowing you have a reliable source of energy is invaluable. protection against blackout requires battery backup, not solar by itself. Will either need to include something about batteries or remove this point.

2. Financial Savings: One of the most compelling reasons to go solar is the potential for significant savings on your electricity bills. By generating your own electricity, you can reduce or eliminate your monthly energy costs, allowing the system to pay for itself Much quicker than most people realize.

3. Environmental Impact: Solar panels allow you to reduce your carbon footprint by producing clean, renewable energy. This is a significant step towards sustainability and protecting the environment for future generations.

4. Tax Breaks & Incentives: In addition to the savings on your energy bills, solar panels also offer financial benefits in the form of tax breaks and incentives. Illinois offers a variety of incentives that can significantly reduce the cost of installing solar panels, making them more accessible to homeowners.

Is Solar Worth It in Illinois? Cost vs Savings

The time it takes to recoup your investment, known as the solar payback period, varies depending on factors such as the size of your system, your electricity usage, and the available incentives. In Illinois, the payback period typically ranges from 4-6 years. Given that solar panels have a lifespan of 25-30+ years, the savings you achieve after breaking even can be substantial.

Incentives for Illinois Solar Panel Installation in Illinois

Solar Tax Credit: The federal solar tax credit, also known as the Investment Tax Credit (ITC), is one of the most significant incentives for homeowners considering solar. The ITC allows you to deduct 30% of the cost of installing a solar energy system from your federal tax liability.

Net Metering: Net metering is another valuable incentive that allows you to earn credits for the excess electricity your solar panels produce. Under a net metering agreement, your utility company credits your account for the energy your solar panels send to the grid, which can be used to offset the cost of the electricity you use when your panels are not generating power (such as at night).

Solar Renewable Energy Credits (SRECs): Illinois also offers Solar Renewable Energy Credits (SRECs) through the Illinois Shines program. You earn one SREC for every 1,000 kWh of electricity your solar panels generate. These credits can be sold to local power companies, providing an additional revenue stream for homeowners. Through the Illinois Shines program you can sell the first 15 years of SRECs upfront. This equates to 25-30% of the system cost in most cases.

Contact us today for more info about solar panel financing in Illinois!

If you’re interested in installing a solar panel system in Illinois, our team can help guide you through the process. Learn more by contacting us at (636) 757-3083